The big story on March 1, 2017 is that the Dow Jones Industrial Average rose 303.31 points, to hit a record high of 21,115.55. As for precious metals, since the beginning of 2017, gold is up $100 per ounce and silver is up $2 per ounce.

Some are attributing the unprecedented rally to Donald Trump’s State of the Union Address on the evening of February 28th, which was well-received, even by his regular detractors at CNN, NBC, etc.

Wall St. appears to be buying on the President’s promises of infrastructure spending, corporate tax cuts and deregulation. This, despite increased signalling from the Federal Reserve Bank of an imminent interest rate hike. This has boosted bank stocks but when you look closer at the details, according to Lynette Zang, Chief Market Analyst at the precious metals firm, ITM Trading, for every $1 worth of stocks purchased on the US stock market on March 1st, $116.04 worth of stocks were sold.

While the stock markets have been zooming upwards, corporate earnings have been steadily sinking. The charts today look exactly like they did, prior to The Crash of 1929.

Sane people are concerned about the “Ides of March”, a reference to the soothsayer’s warning to the protagonist of Shakespeare’s eponymous tragedy, Julius Caesar. These concerns are based on the upcoming March 15th meeting of Congress to vote on the debt ceiling. Currently, there’s only enough money in the Treasury to keep the US Government going through August.

Former Reagan Administration White House Budget Director, David Stockman has been very vocal about this rally, calling it “insanity”. Stockman is predicting, “A fiscal bloodbath and a White House train wreck like never before in US history” – and a likely government shutdown.

He says, “There will not be Obamacare repeal and replace. There will be no tax cut. There will be no infrastructure stimulus. There will be just one giant fiscal bloodbath over a debt ceiling that has to be increased and no one wants to vote for.”

I’ve never heard of Lynette Zang before, but I find her under-5-minute presentation here to be a truly excellent summary of the financial situation and of the “Severely, ridiculously overvalued and very, very vulnerable market.”

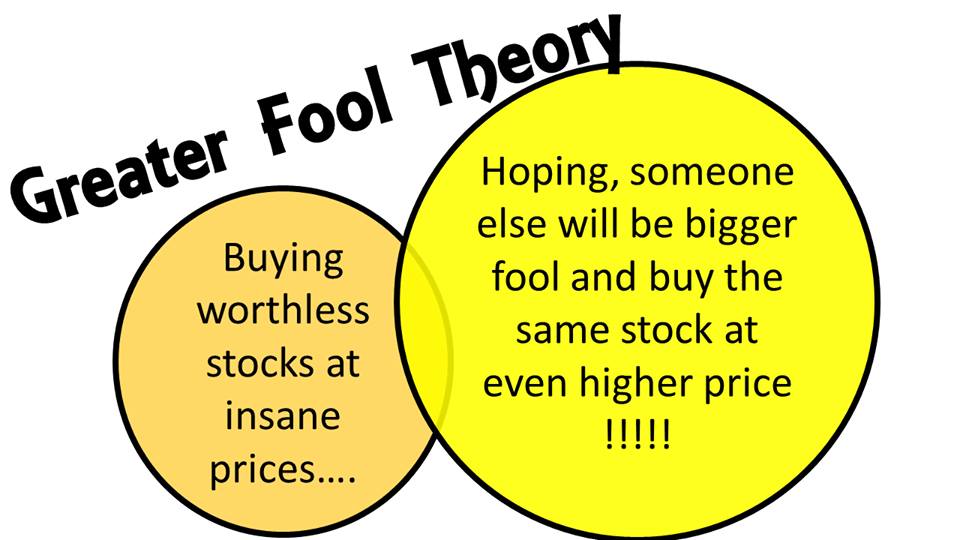

What is the “Greater Fool Theory”? Let’s find out!